DLC Markets Launches Bilateral Options Booking & Settlement

We are excited to announce the addition of options booking & settlement in DLC Markets! In this post, we will detail how we can automate margin call, liquidation and settlement for options to ensure a smooth trading process with institutional-grade security.

The first version of the DLC Markets platform featured Bitcoin inverse futures. The idea was to present a simple BTC derivatives product to obtain a flawless process between a financial instrument’s inputs and the Discreet Log Contract (DLC) construction, CETs computation and outputs.

We have been publishing a few articles about DLCs, the security model of DLC Markets, its engineering, and how it addresses crypto derivatives trading desks’ needs.

Today, we are excited to announce the addition of options booking & settlement in DLC Markets!

In this post, we will detail how we can automate margin call, liquidation and settlement for options to ensure a smooth trading process with institutional-grade security.

A streamlined trading process for on-chain booking and settlement

We believe bilateral options trading should be straightforward, flexible and secure.

DLC Markets allows traders to leverage the Bitcoin blockchain itself as their collateral custodian and to fully automate the booking and settlement of their derivatives, removing tedious manual management in the process

With the DLC Markets platform, users can experience institutional-grade options trading with Bitcoin's security guarantees through:

- Simple Connection: start booking your pre-agreed bilateral option contracts through our user-friendly interface by just connecting your Bitcoin wallet

- Flexible Customization: design bespoke options strategies

- Walk through steps: from the DLC creation, sending collateral/premium into the DLC to the transaction being finalized, the system notifications will guide you all along the different stages

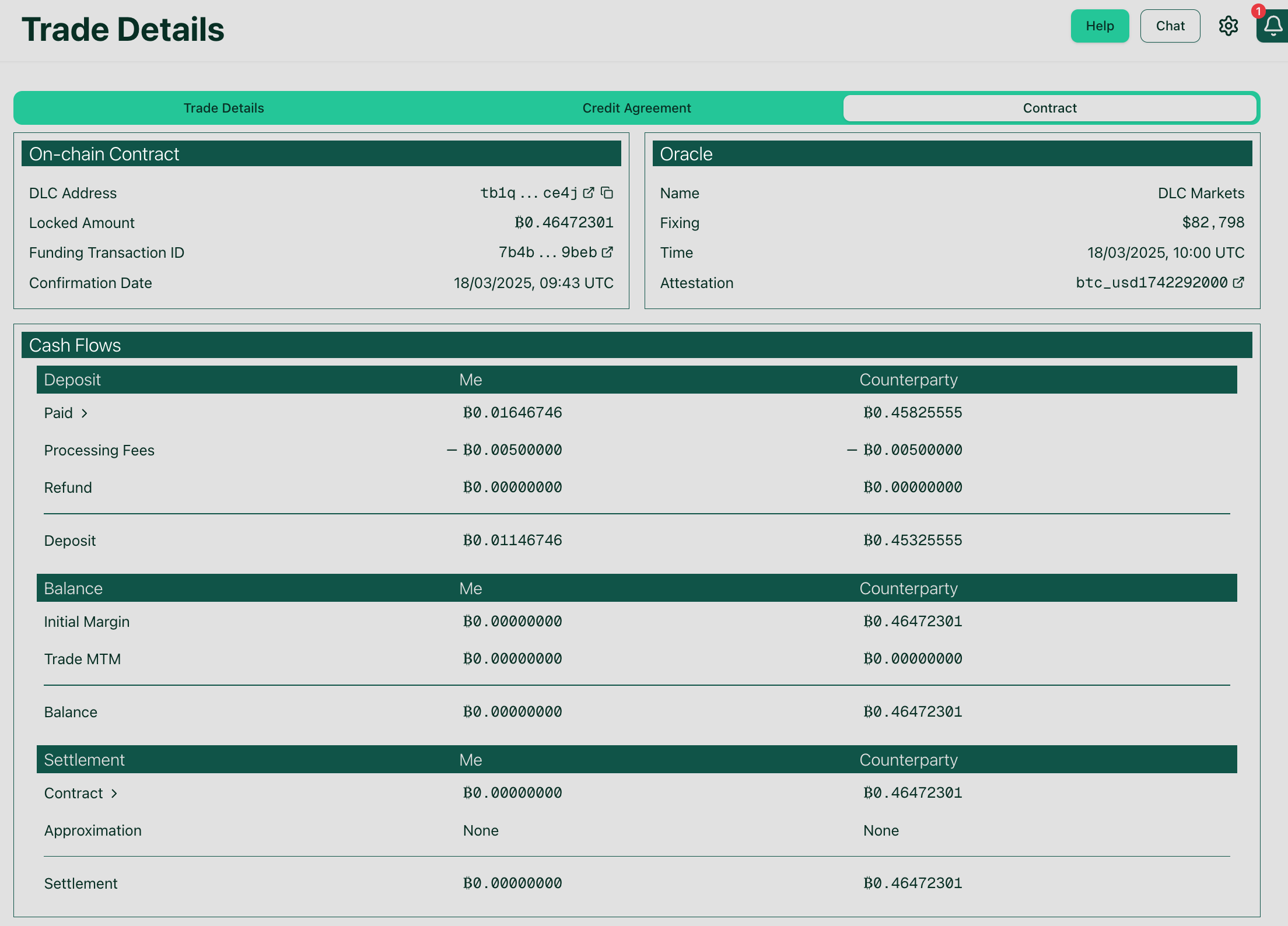

- Direct Settlement: automatic, trustless execution at expiry that solely rely on independent Oracle publications

- Full Privacy: only the two parties involved are aware that this contract exists. The agreement remains confidential between counterparties with no third-party visibility.

- Total Transparency: all contracts and funds are visible on the Bitcoin blockchain, providing verifiable proof of transactions while maintaining privacy of the parties' identities.

How It Works

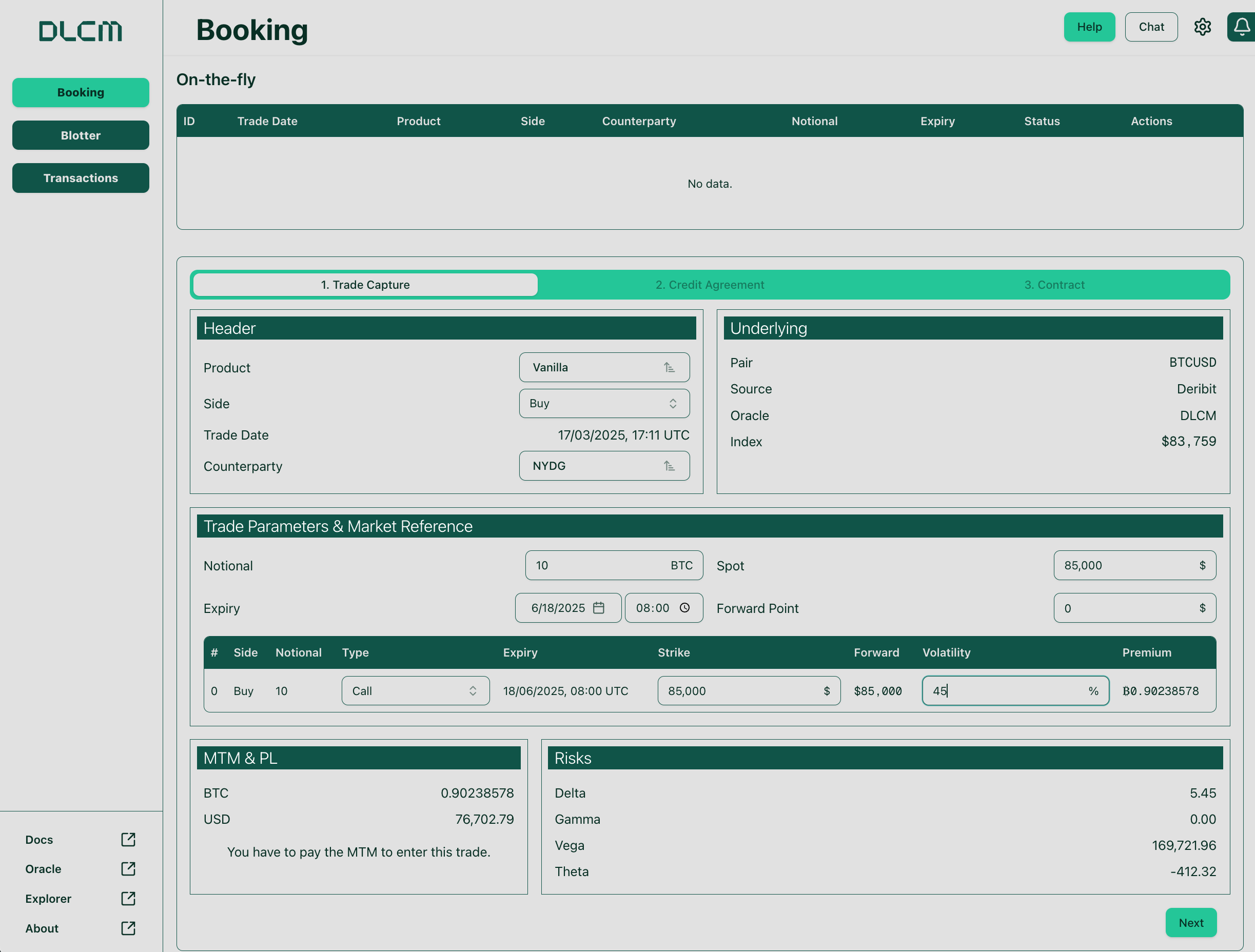

Traders can book their options through a simple, user-friendly interface.

1/ Trade Creation

Traders begin by inputting trade details including the underlying asset, option type, expiry date, notional value, volatility, spot price, and forward points. The system features an embedded Black-Scholes pricer that automatically calculates option prices and the Greeks.

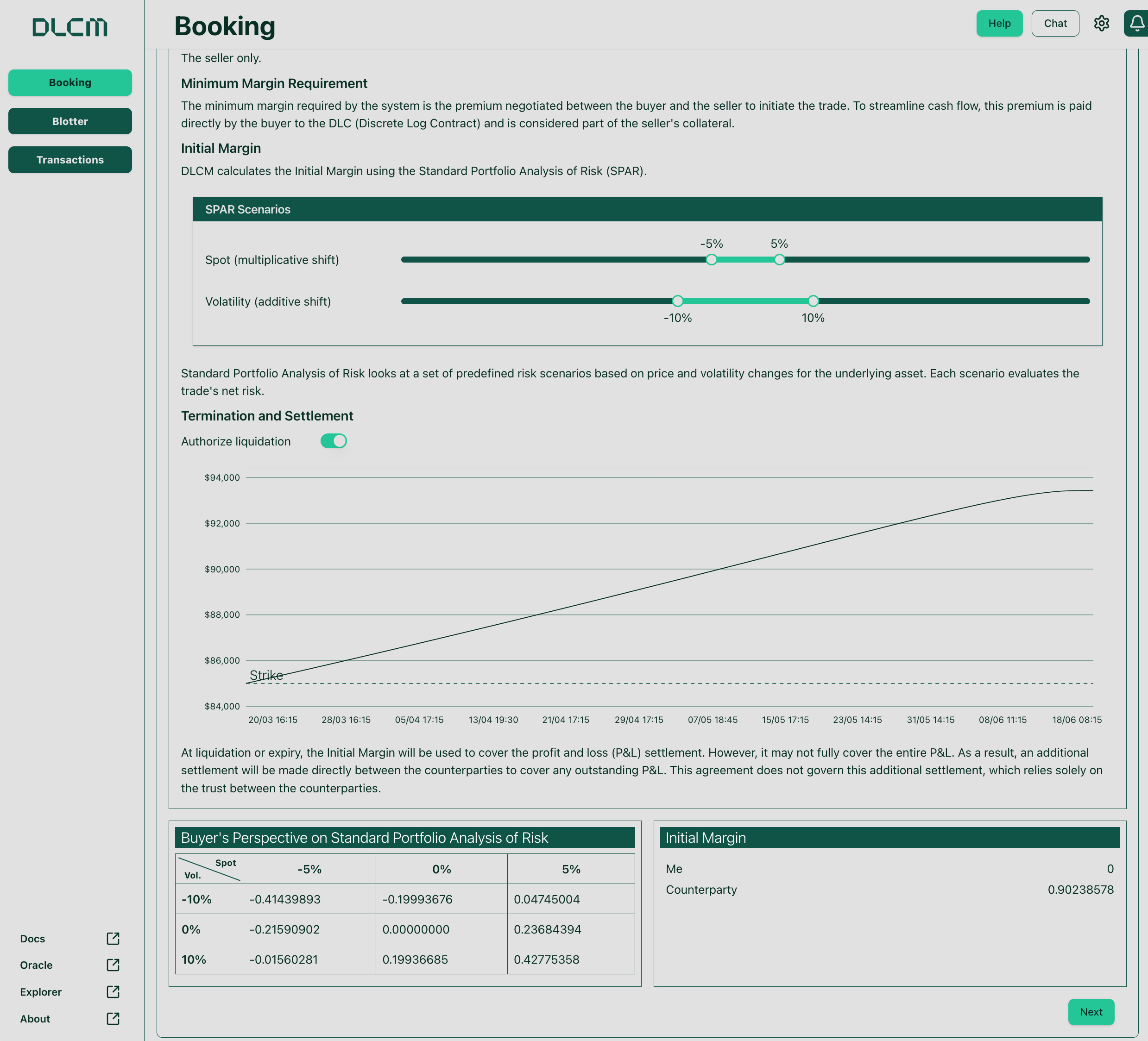

The system also automatically calculates the required initial margin using the SPAR model, which is based on spot and volatility changes that counterparties can adjust according to their preferences. Traders have the choice to enable or disable liquidations during this stage. A diagram of the liquidation threshold is displayed according to pre-set SPAR shifts, providing visual guidance for risk management.

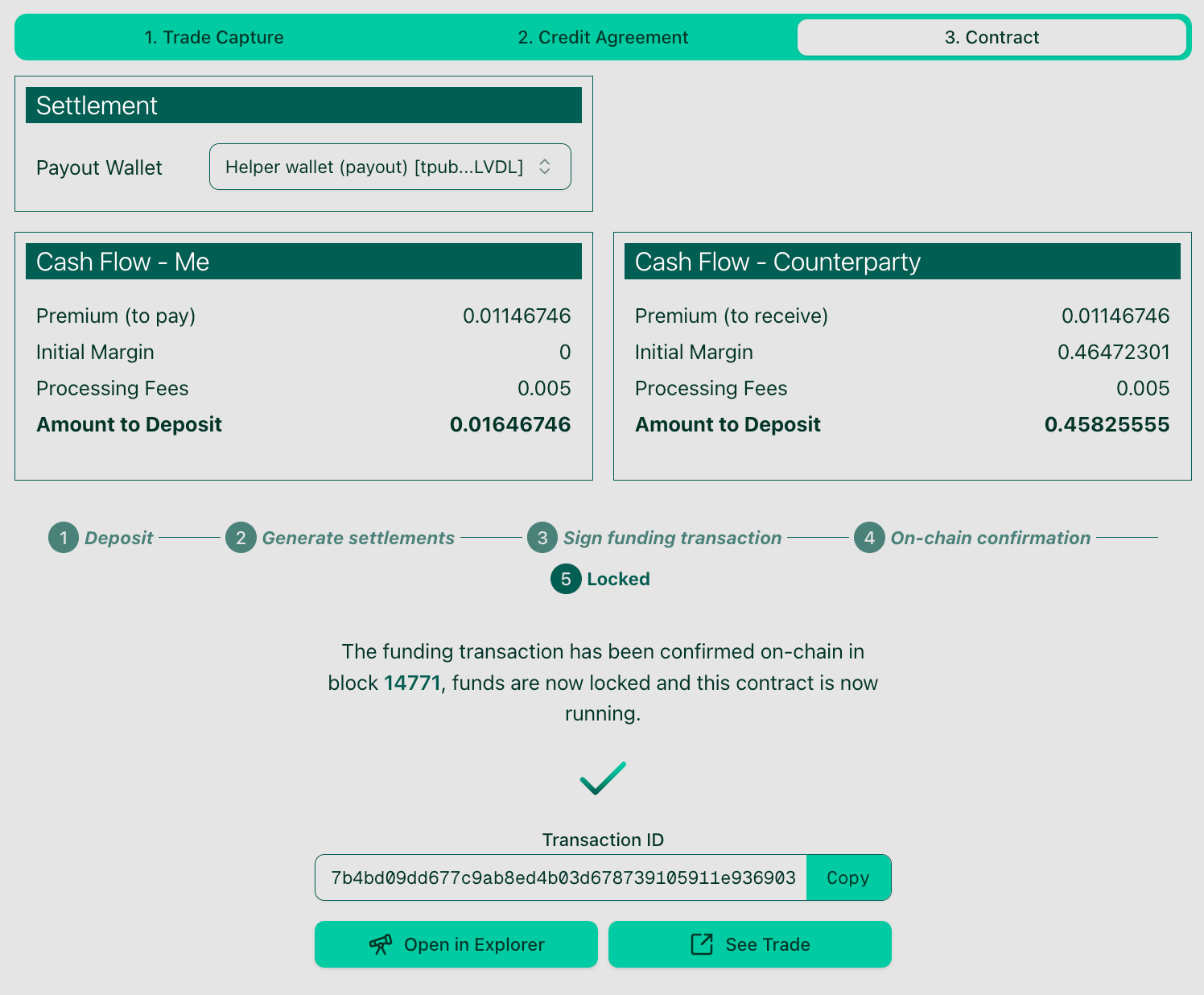

2/ Trade Confirmation and Execution

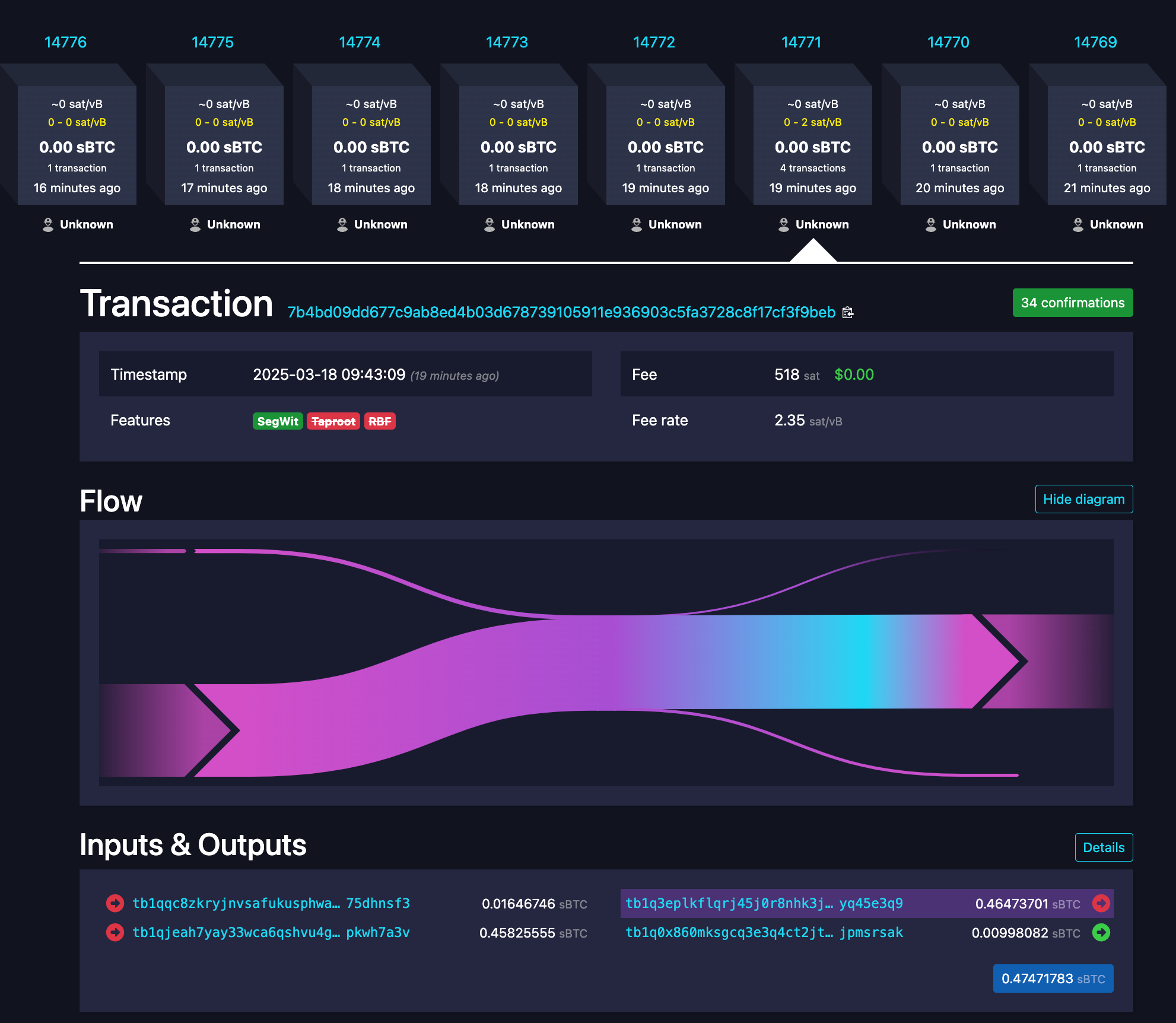

Once the trade parameters are established, one of the counterparties will input these agreed trade parameters and send the trade to the other party for review. The receiving party can then accept or refuse the trade. Upon acceptance, collateralization takes place, with the seller posting the required margin while the buyer pays the premium. The system then constructs the Discreet Log Contract (DLC) and collects necessary signatures. Throughout this process, the system provides notifications for each step until the transaction is confirmed in an observable block number that is provided to both parties.

3/ Settlement

At expiry, settlement occurs automatically through the DLC protocol according to the terms established during the initial trade creation. This automated settlement ensures that the contract is executed precisely as agreed upon by both parties.

Premium management

Options require a premium payment by the option buyer to the seller. While this could be handled outside the DLC, DLC Markets incorporates premium exchange directly within the transaction that opens the trade. The premium paid by the buyer is deducted from the collateral posted by the seller.

This has several advantages:

- Unified trading experience: premium negotiation occurs in the same place as the contract payoff, with all trade information visible in DLCM—no need to reference multiple sources.

- Guaranteed premium return: since the premium is included in the DLC, the option buyer is guaranteed to receive it back if breakeven is reached.

- Atomic premium exchange: the premium is exchanged in the same transaction that opens the DLC, eliminating counterparty risk. The seller will not open a DLC without receiving the premium, and the buyer is guaranteed to benefit from the option they paid for.

Designing Liquidation & Margin Calls

In options contracts, unlike futures, the appropriate liquidation price cannot be fixed. It must change over time to reflect the option's changing value as we get closer to its expiration date. On DLC Markets, rather than directly specifying premiums, parties negotiate Black-Scholes parameters which allow us to calculate the theoretical option value at any point before expiry and to set dynamic liquidation thresholds that adjust with time.

For each potential liquidation point in the contract lifetime, we determine the spot price at which the option's theoretical value equals the collateral in the DLC. This creates a schedule of liquidation thresholds that changes over the duration of the option.

To integrate margin calls within a DLC, it’s important to remember that a DLC functions as a one-time-use account with a key constraint: any input or output from this account requires creating a new DLC.

That being said, adding margin to an existing DLC is simpler than establishing an entirely new contract with different parameters, but still requires generating a new DLC. The derivative terms remain unchanged—only the party required to add margin needs to make a deposit.

Both parties must participate in creating the new DLC through these steps:

- Party A (adding margin) provides deposit information and pre-signs new settlement transactions

- Party B receives these transactions, pre-signs them, verifies Party A's signatures, and signs the transactions to renew the DLC

- Party A verifies Party B's pre-signatures and provides the final signature to launch the new DLC on-chain

DLC Markets guides participants through each step of this process.

Superior Security Through Simplicity

DLC Markets' options trading is built on simple, robust primitives:

- Battle-tested Security: options contracts are secured by Bitcoin's proven 2-of-2 multisig scripts, eliminating smart contract vulnerabilities

- No Code Complexity: avoid the risks of Turing-complete smart contracts and their potential exploits

- Guaranteed Fund Recovery: in any oracle failure scenario, counterparties automatically recover their initial deposits (cf DLC Markets Security Model article)

- Direct Bilateral Settlement: funds are never locked in complex smart contracts or controlled by third parties

Risk Management Framework

Our security model provides multiple advantages over traditional platforms:

- Cooperative Settlement: Counterparties can mutually agree to modify settlement terms

- No Platform Risk: DLC Markets never controls user funds

- Transparent Verification: All contract parameters are independently verifiable

Roadmap

With the launch of our MVP for vanilla options booking and settlement, we aim to conduct test trades with strategic partners on Bitcoin mainnet. Yet, we have started to outline the roadmap of a second version with more products (option strategies, multi-leg options..) delta neutral features and different option expiries.

We are also thinking of offering a different source Oracles (counterparties could choose their preferred Oracle source) and a multi Oracle signature (2-3 Oracles attesting the price at the same time).

Ready to experience the future of Options trading on the Bitcoin blockchain ?

We invite financial institutions, professional traders, and Bitcoin enterprises to connect with us now at contact@dlcmarkets.com or visit dlcmarkets.com and discover how you can be among the early access partners to trade Bitcoin options the way they were meant to be traded—on-chain secure, non-custodial, and on your terms.

Early adopters will benefit from:

- Designing their bespoke specifications

- Shaping with us future product development according to their requirements

- Dedicated onboarding support

- Exclusive fee structure

Trade smarter. Trade safer. Trade with DLC Markets.